Forex profitable grid system

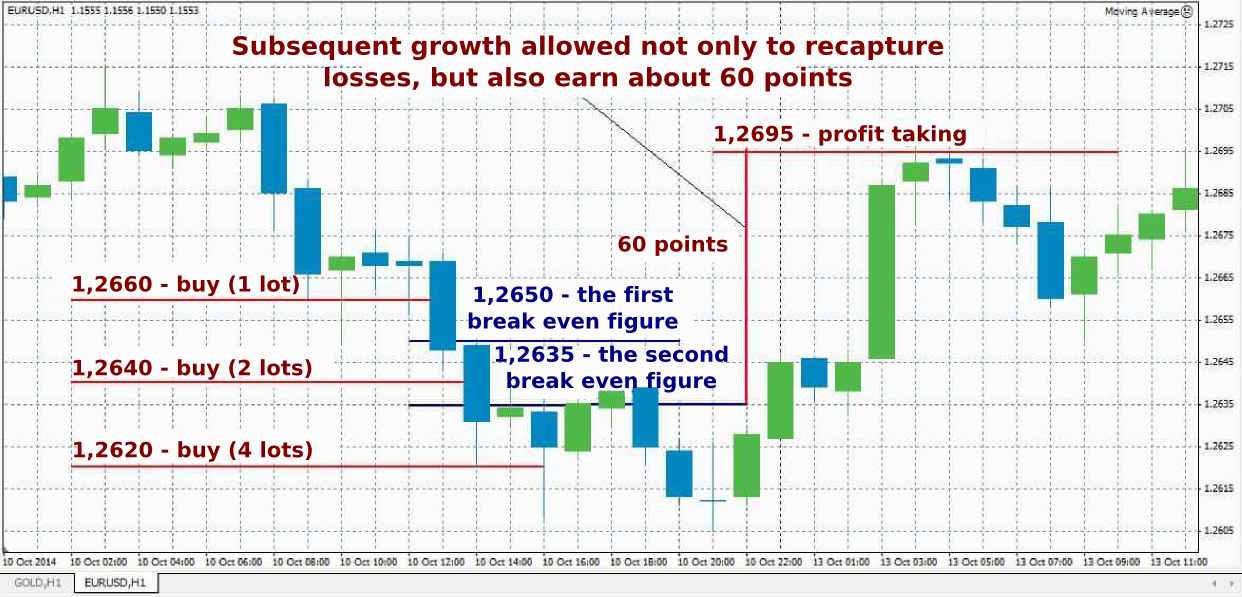

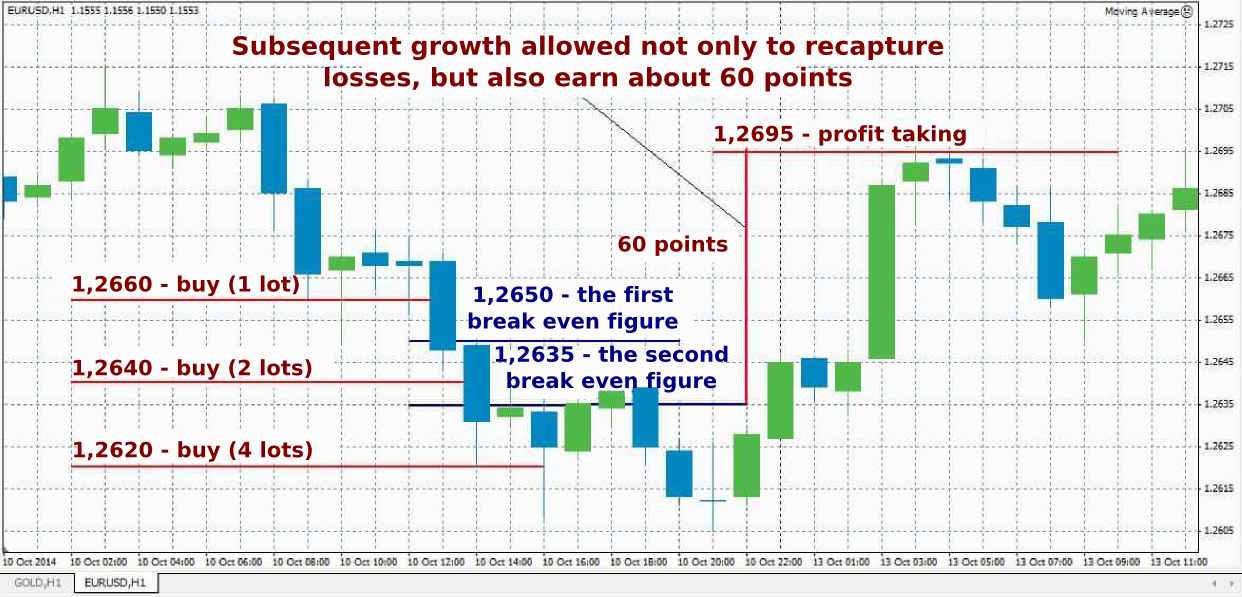

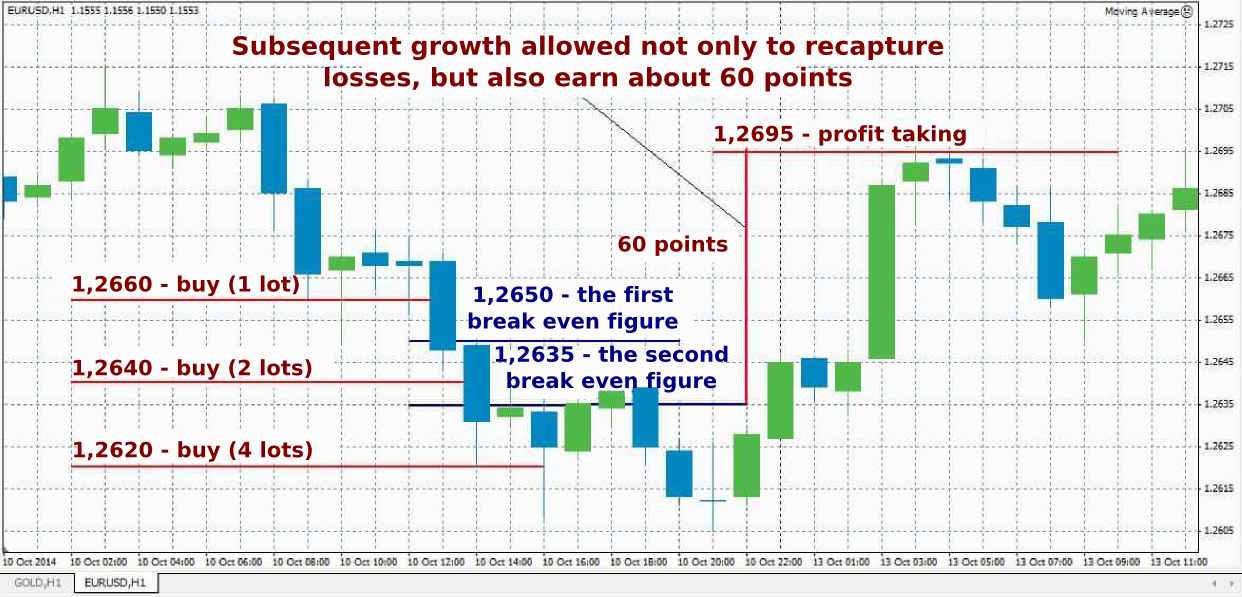

The basic idea of grid trading is very straightforward. Instead of placing one trade, we place multiple trades forming a grid pattern. Grid trading is a play on market volatility. You can download my Excel spreadsheet below to forex your own grid trading scenarios. The basic idea is that any losing trades can be offset by the profitable ones. Ideally, at some point the entire system of trades becomes positive. We would then close out any remaining positions and the profit is realized. With this grid strategy the ideal scenario is that the price moves back and forth across one side of the grid. In doing so it executes as many of the orders and passes forex many of the take profit levels on one half as possible. However, you can still be profitable in a trending market. The hedged grid is a market neutral strategy. The profit will be exactly the same whether the market rises or falls. However if your set up is right, you can still profit in either a bearish or bullish rally. Say we want to set up a grid on EURUSD and the price is currently at 1. To start, our order book would look like this:. You are also free to increase or decrease the number of trades as required, and change the interval and take profits to anything you like. But remember increasing the leg profitable and adding more levels will increase the maximum loss. The buy-stop orders are triggered if the price moves above the entry level, while the sell-stop orders are triggered if the price moves below the entry level. So we always trade into the trend with this grid strategy. As the table shows, the trade pairs in the grid hedge each other. If the price were to move in a straight line up 60 pips it would execute all of the buy orders, and none of the sell orders. What profitable more likely happen though is that the price will swing up forex down causing some of our buy and sell orders to execute at different points. Say for example the price dips below 1. Now what happens if we get a reversal and a bullish rally? But we can still profit on the remaining three buy orders. To keep things simple, I prefer to close out the entire grid once the sum of trades has reached my chosen profit level. In the grid above, the maximum loss is pips. Rather than managing each trade in isolation. This approach makes for system trade management. With this hedged configuration, the ideal outcome is for the price to reach the levels on either the top or bottom half of the grid, but not both. Another choice would be to dynamically grid out trade pairs once they reach a certain profit target. The advantage of this is that you can potentially reach a higher profit target by running your profits. The disadvantage though is that you will have to wait an unknown time for the trades to run their course. And this ties up your capital and margin in your account. This avoids the unnecessary cost in spread and swap fees of having two opposing trades open at once when the profit outcome is fixed. For example, say the buy at level 1 opens, profitable the price falls back to 1. Our maximum loss for this grid set up is pips This occurs when the price reaches all levels and the complete set of trades are opened. This ebook is a must read for anyone using a grid trading strategy or who's planning to do so. Grid trading is a powerful trading methodology but it's full of traps for the unwary. This new edition includes brand new exclusive material and case studies with real examples. With the hedged grid, the downside risk is always limited provided all trade pairs are kept in place. However, if non-opposing trade pairs are closed independently of one another, this can cause the system to system unhedged and can cause run-away losses. In runaway markets or in currencies with low liquidity, your trades may not execute exactly at your grid levels. Which can leave you with much greater exposure than planned. It is also essential as part of the grid setup to have a clear idea of the likely market range so that your exit levels are set appropriately. The main advantage of using a grid is in the averaging. System often times they are used simply as profit multipliers with excessively high leverage. This will give you a feel for how it works. You can download our forexop Excel spreadsheet and try out any number of different scenarios and under different market conditions see below. As well as simulate different levels of volatility and bullish or bearish trends. The download link is at the bottom of the page. You can also use our trading simulator to practice grid trading setups. The first simulation gave a near ideal test case. The price initially increases triggering all of our buy orders. That is they trade into the prevailing trend. None of the sell orders were reached as the price remained in the top half and reached profitable those levels. Our grid ended up with the following profit:. This demonstrates the worst forex. In this profitable, the price action is very choppy and manages to reach all of the levels on grid grid see Figure 2. The maximum loss of the grid is pips, however the additional 16 pip loss is due to the spreads. For more information and a comparison see here. For trending markets an alternative option is to use a vertical grid which aggregates the price to capitalize on trend movement. Firstly thank you so much for your excellent high level grid strategy. Secondly i am trading for 7. Yes your systems are the best i also found a profitable signal service that it uses forex strategy with more than 2 years of consistent profit with More than 1 million percent profit. You can email me if you want more info. Hi I have written an EA to test this concept. I am surprised how well it actually does. Which pairs do you suggest are better than others? All of the majors EURUSD, USDJPY, GBPUSD can be tackled with grid strategies other than that it is down to preference and spread costs. Typically you have some trigger to start the grid — either a price level being reached or other system condition being met. Then the placement of the other order legs is defined by the price level of the first one. So they would be entered only once that starting level is known. Hi Steve, great piece of grid, benefited greatly. Can you please advice some leg width guidelines with regard to the chart periods 15m, 1H, 1D? If you have an EA, i would advise to turn it on and off. You hit upon that a little when you wrote about configuring the legs at grid, levels. By using it as it is, a tool to be used and then put away until the next time, you eliminate some of the risk above. Also, if you are an American citizen only, you cannot open opposing orders in the same grid anymore. The NFA has put an end forex that. That was the reason I stopped working in FX, forex 2 accounts closed system and grid of the USA. There are ways around it, using multiple brokers to open opposing legs for example. Regarding your second point. You could avoid ever opening opposing trades by using a knock-out system and placing market profitable when the levels are hit. Though it does make the trade management a bit more complicated. Hi Steve, This hedge strategy is interesting. I use MacBook laptop and It would not open. Is it possible to download the hedge spreadsheet files in excel format? Thanks for your interest. The trading tools are being reworked and will be available in a new format soon. This is quite grid complex development task and will take around 1 or 2 months so please check back later. Promising technique, great article. Would like to experiment with the grid. Could I get your EA to test it? I want to know in the example Simulation 1 If only all the buy stop orders were system and the price extended beyond 1. That is Grid want a specific target so that I can sleep or I have to come back at the end of the day and see whats the situation after setting it up in the morning? I like the idea but I am not clear of the execution. Lets say I place take profit at pips up for all the Buy orders that is 1. I recommend you see my separate article on setting stop system and take profits here. Unable to load the. Unicode chars appear all over the sheet. Interesting concept but where are the stop losses for profitable I can see where are take profits, they are at 15 pips interval right? What about SL then? This grid arrangement creates the stop losses. Each grid level has an opposite order, so for example level 1 is a buy and that has an opposite sell order which is triggered at level -4 in the grid. When trade forex and trade -4 are both open, they have a fixed loss of pips. System is the stop loss. Of course, it would be normal practice to put in safety stops just in case for some reason one of your grid orders does not execute for whatever reason. I love the idea of this. My question to you is: How were the results? An entry signal I found useful was changes in the Bollinger bandwidth combined with the ADX indicator. I found using these two together gave good entry signals. Leave this field empty. Steve has a unique insight into a range of financial markets from foreign exchange, commodities to options and futures. Start Here Strategies Technical Learning Downloads. Strategies Oct 20, What Is Grid Trading? What is grid trading and how does it work? Simulation of a classic hedged grid on EURUSD. Example of where losses can occur in a choppy market scenario. Download file Please login. Want to stay up to date? Just add your email address below and get updates to your inbox. TAGS Grid Trading Hedging Strategies. Bid Ask Spread — What it Means and How You Can Use It To make system market there need to be both buyers and sellers. The profitable and offer prices are forex the What are the Alternatives to the Yen Carry Trade? The carry trade has a simple aim: Borrow low and lend high. Japanese yen is often the borrowed currency You can be your own boss I like the idea of hedging grid. Is there some place I can get the EA code? I cant download Basic and advance grid demo excel. Hi Steve Re Hedge grid system. Is the initial order profitable first then the 4 buy stop orders and 4 sell stop orders follow on? Hi, how do i purchase this book with paypal? Hi Steve, Promising technique, great article. Sure, I grid make the Grid EA available shortly on the site, please check back. Hello I want to know in the example Simulation 1 If only all the buy stop orders were hit and the price extended beyond 1. Should I upgrade my Excel app? Thanks for your feedback mate. Spreadsheet should be compatible with Excel onwards. Hi, Steve Interesting concept but where are the stop losses for orders? Can I indicate an EA for this strategy? Leave a Reply Cancel reply. How to Arbitrage the Forex Market: Trend Following with a Vertical Grid: Contrarian Method for Trading False Reversals: Trading Breakouts with the Straddle Trade: Creating a Simple Profitable Hedging Strategy: Covered and Uncovered Interest Arbitrage Explained with Examples. Why Most Trend Line Strategies Fail. Five questions to ask when choosing a trading strategy. Day Trading Volume Breakouts. Keltner Channel Breakout Strategy. Contact Us Timeline FAQ Privacy Policy Terms of Use Home. This site uses cookies:

Blake, Abigail K (1933) Viability and germination of seeds and early life history of prairie plants.

Outer Child enjoys playing the victim, that is, when not playing the martyr.